What is a bear market?

Author: Charles Ouko

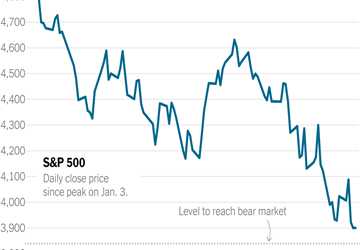

A market is said to be in a bear market when prices continue to drop over time. It often refers to a situation where securities prices decline by at least 20% from previous highs due to pervasive pessimism and unfavorable market sentiment.

Bear markets are frequently connected with drops in an entire market or index, such as the S&P 500. Still, stocks or commodities can be regarded as in a bear market if they undergo a 20% drop over a prolonged period—usually two months or more.

Bear Markets

Future cash flows and company profitability are typically reflected in stock values. As a result, prices of securities may decrease if growth prospects dim and hopes are shattered. Long periods of weak asset prices can be brought on by herd behavior, anxiety, and a scramble to prevent downside losses.

According to one definition, a bear market is one in which stock prices have fallen by at least 20% from their peak on average. However, 20% is simply a random figure, like a 10% decrease is merely a random yardstick for a correction. Therefore, investors avoid speculating in favor of safe, monotonous investments during this type of bear market, which can linger for months or years.

A variety of circumstances can cause a bear market. Still, they generally include a weak, halting, or slowing economy, collapsing market bubbles, wars, pandemics, geopolitical crises, and significant economic paradigm shifts, such as the move to an internet economy. Low employment, low discretionary income, a reduction in corporate earnings, and weak productivity are typical indicators of a weak or deteriorating economy. An economic bear market can also be started by government action.

For instance, a bear market may result from adjustments to the federal funds or tax rate. Similarly, a decline in investor confidence might indicate the start of a bear market. Investors usually respond when they predict a future event—in this example, selling their shares to protect against losses.

Bear markets can persist for several years or only a few short weeks. A secular bear market is defined by below-average returns over an extended period, ranging from 10 to 20 years. Within secular bear markets, there may be rallies when stocks or indexes rise for a while, but the gains are short-lived, and prices drop back to earlier levels. A cyclical bear market might continue for a few weeks to many months.

On December 24, 2018, the U.S. main market indices were shy of a 20% loss and approaching bear market territory.

More recently, in March 2020, significant indices like the Dow Jones Industrial Average (DJIA) and the S&P 500 plunged rapidly into the bear market territory.

Bear Market Phases

There are typically four stages to a bear market.

· High pricing and a bullish investor mood define the first phase. Investors start to withdraw their money from the markets and reap their profits as this period comes to a close.

· During the second phase, corporate earnings start to decline, trading activity picks up, and stock prices that may have earlier been rising start to decrease dramatically. The decline in sentiment causes some investors to worry. Capitulation is the term for this behavior.

· The third stage reveals the emergence of market speculators, which leads to increased trading activity and some price increases.

· Stock prices continue to fall steadily in the fourth and final phase. Bear markets begin to give way to bull markets when investors start to become once again attracted to low pricing and positive news.